Class 12 Accounts Fundamental Of Accounts Notes

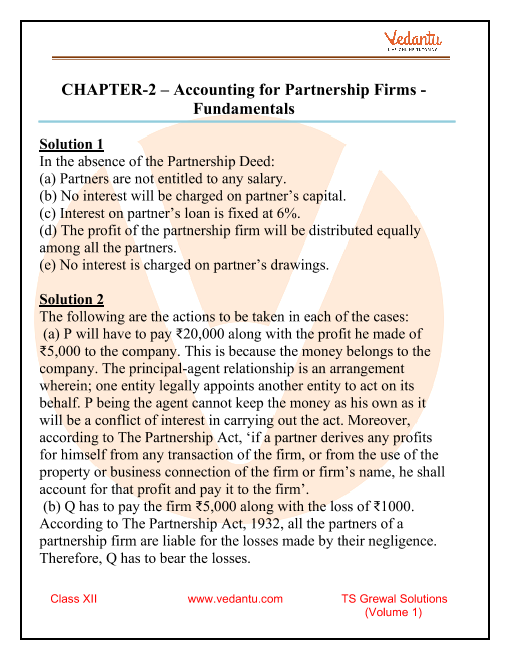

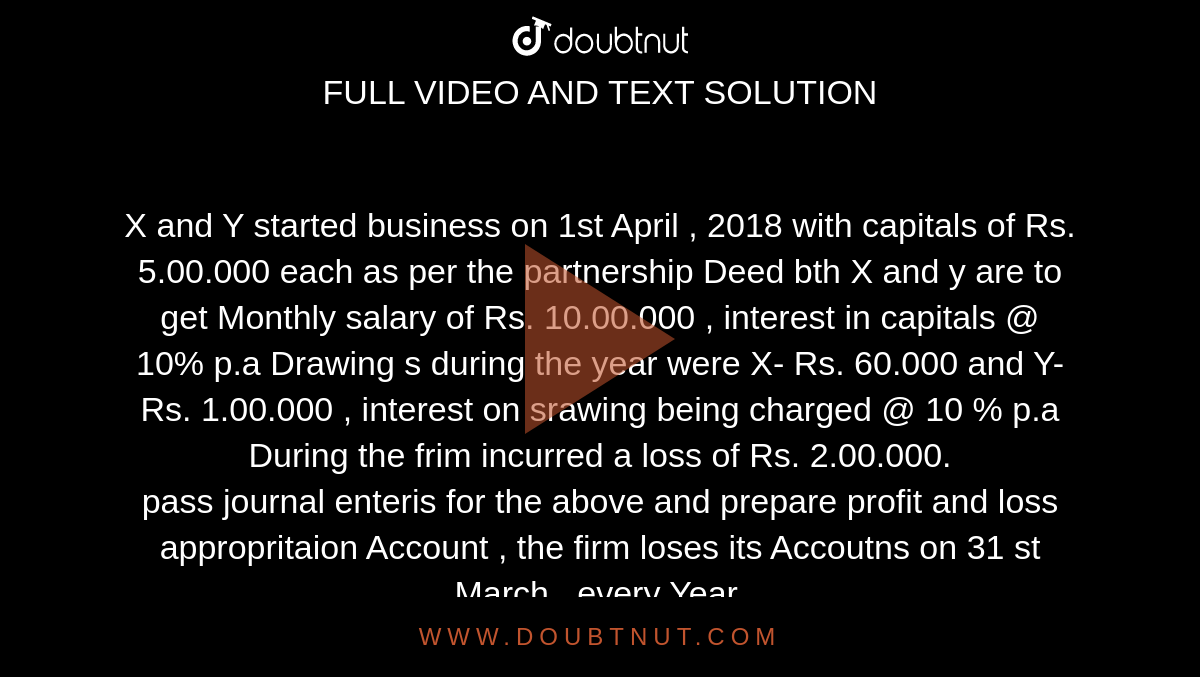

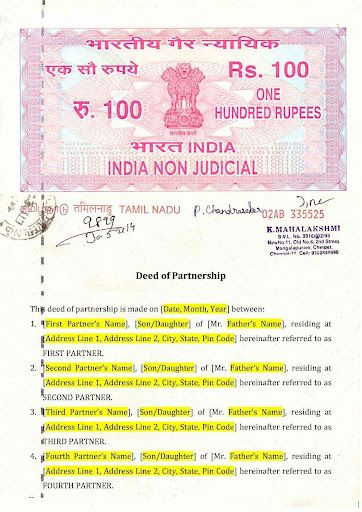

However, for any loan Ajith will be charged @ 6% per annum According to Partnership Act, 1932, a person can be admitted as partner only when the other partners had consented to admit On theAccording to partnership act 1934, In the

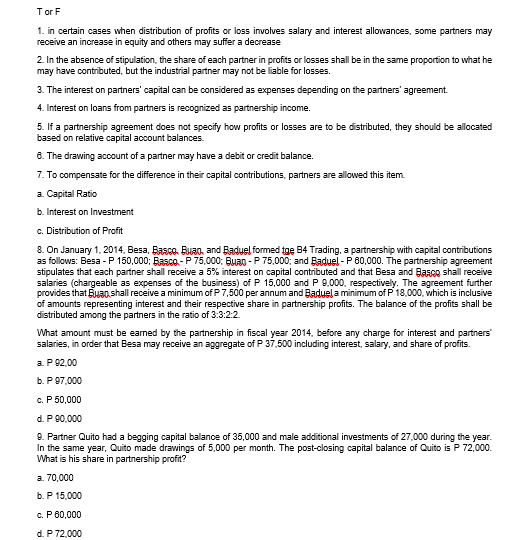

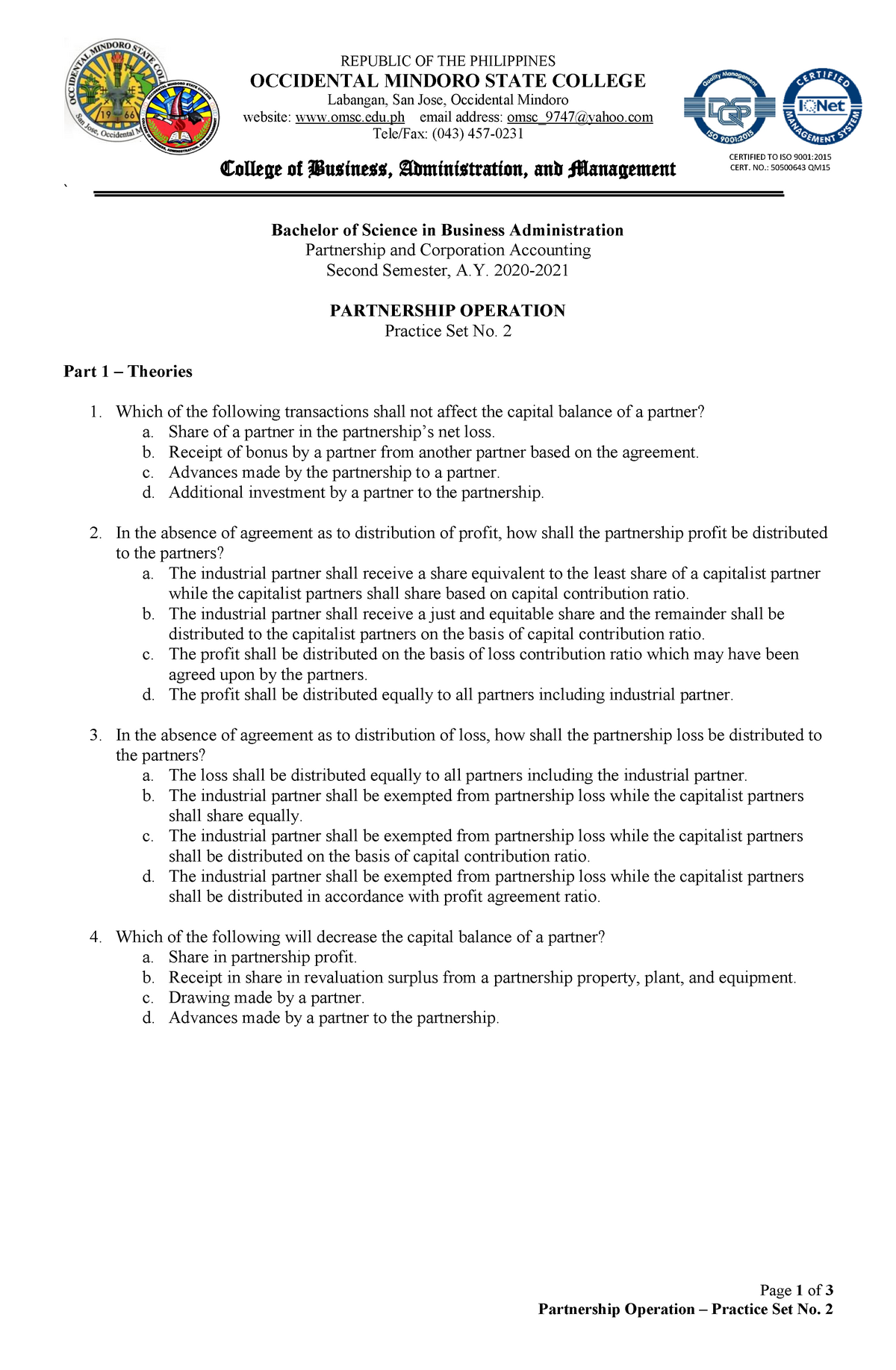

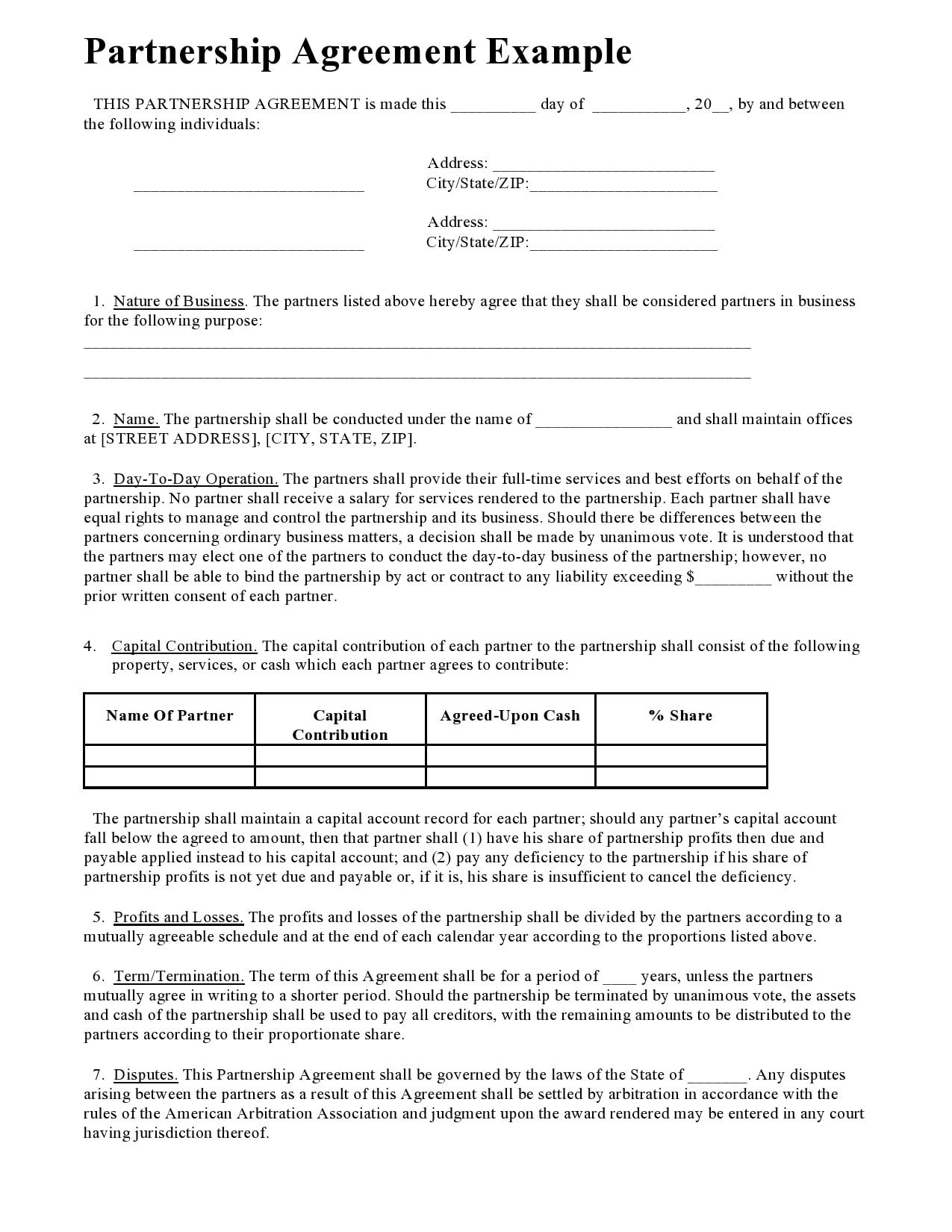

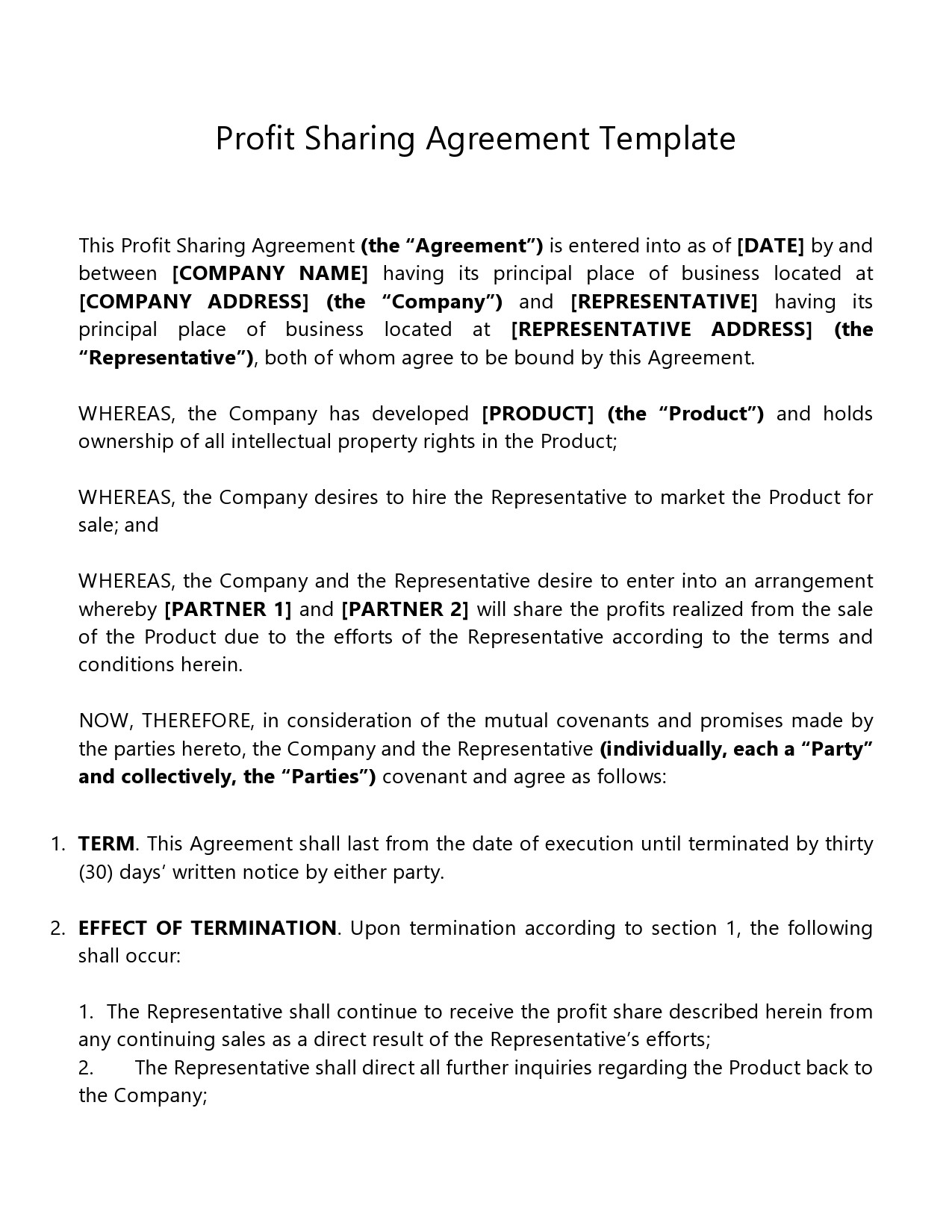

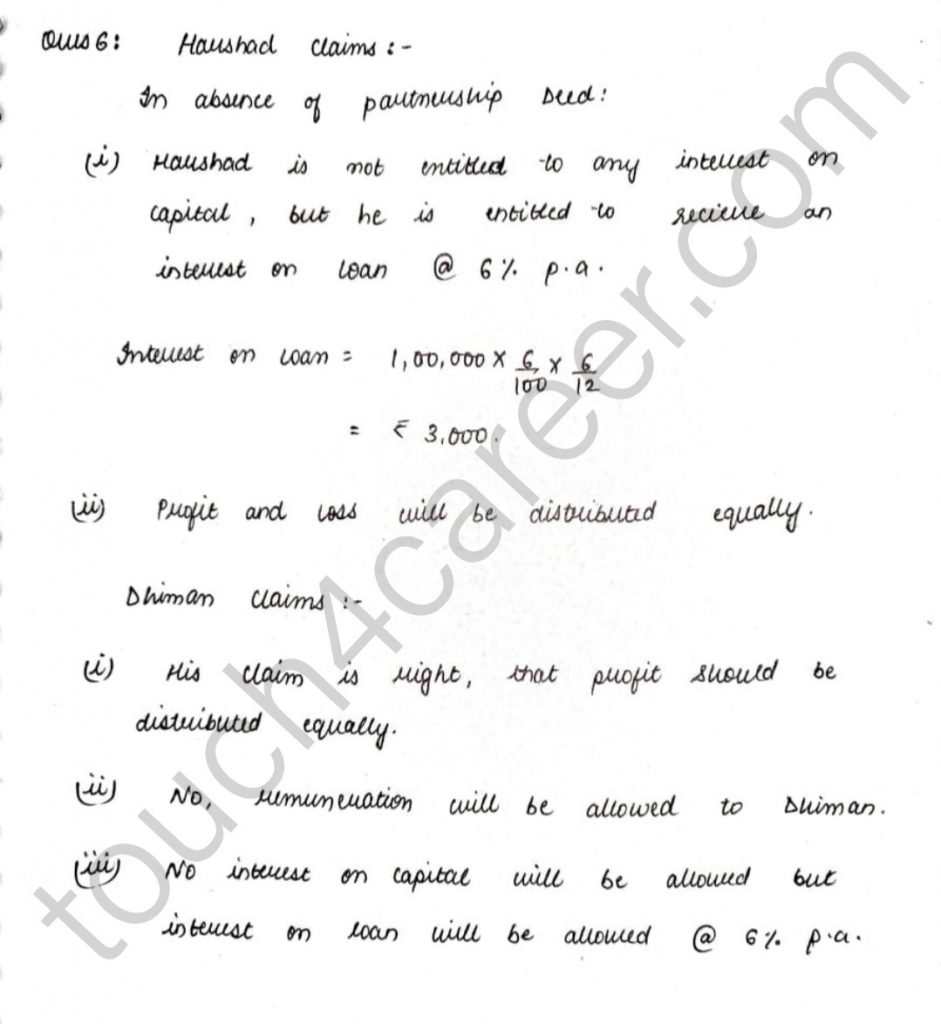

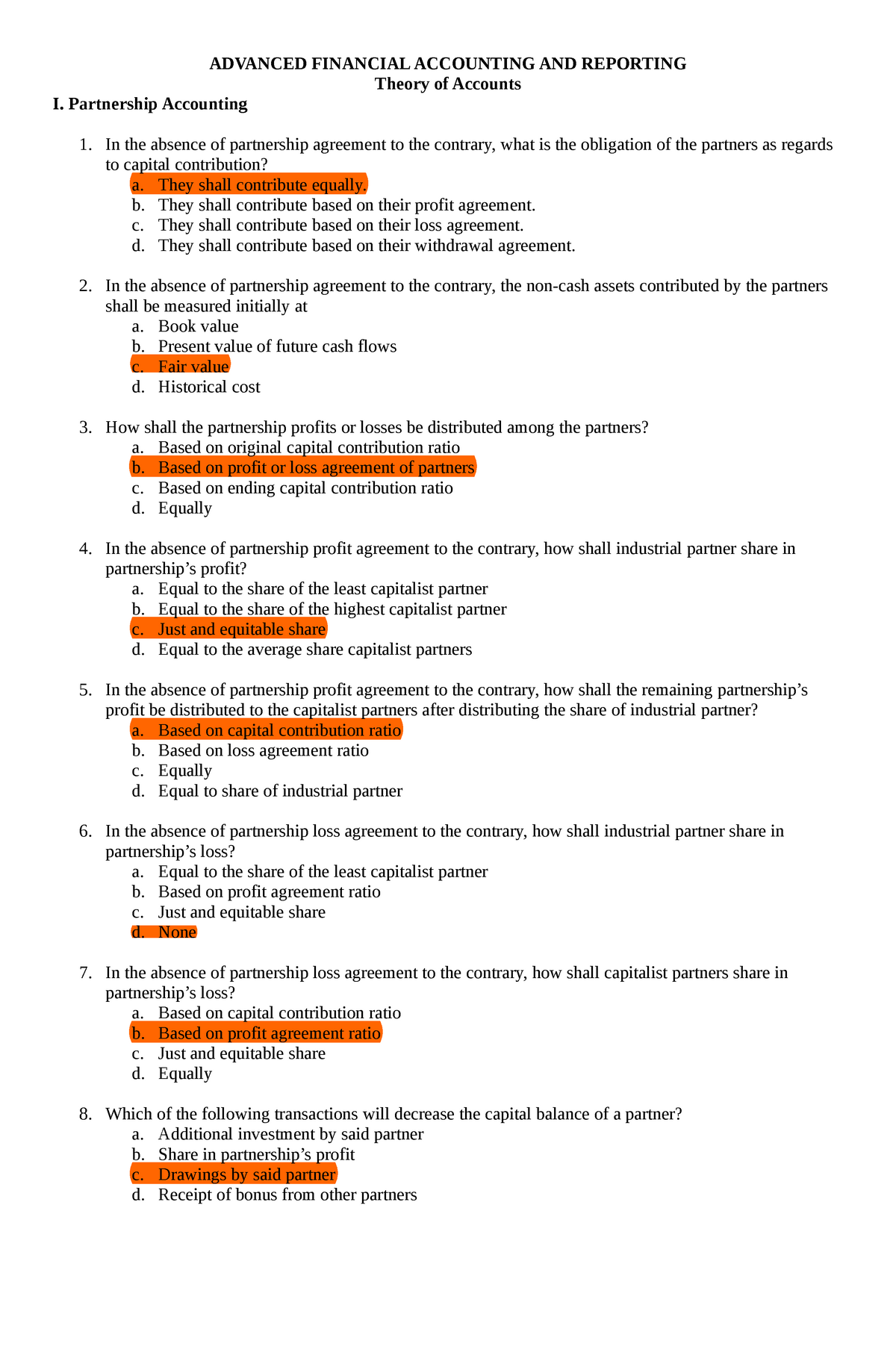

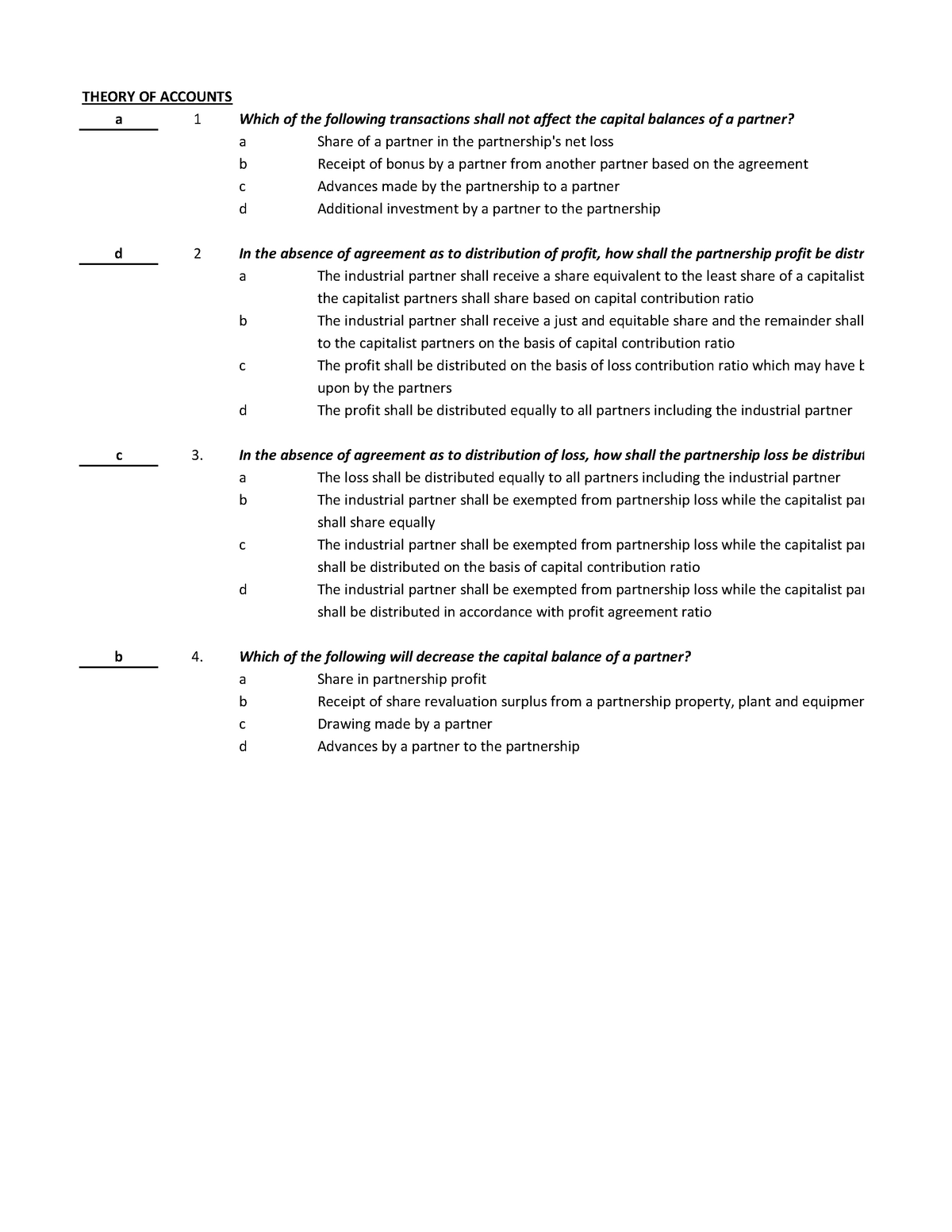

In absence of partnership deed how is profit distributed

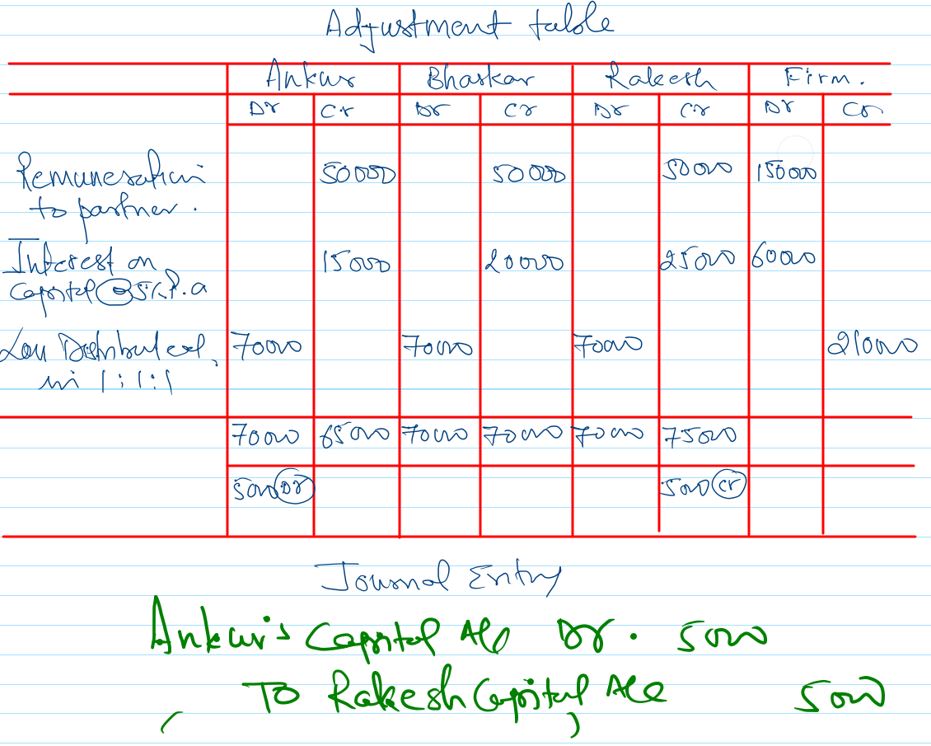

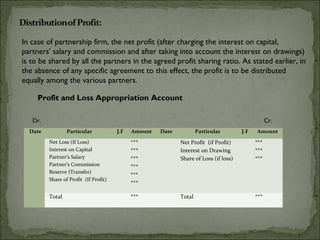

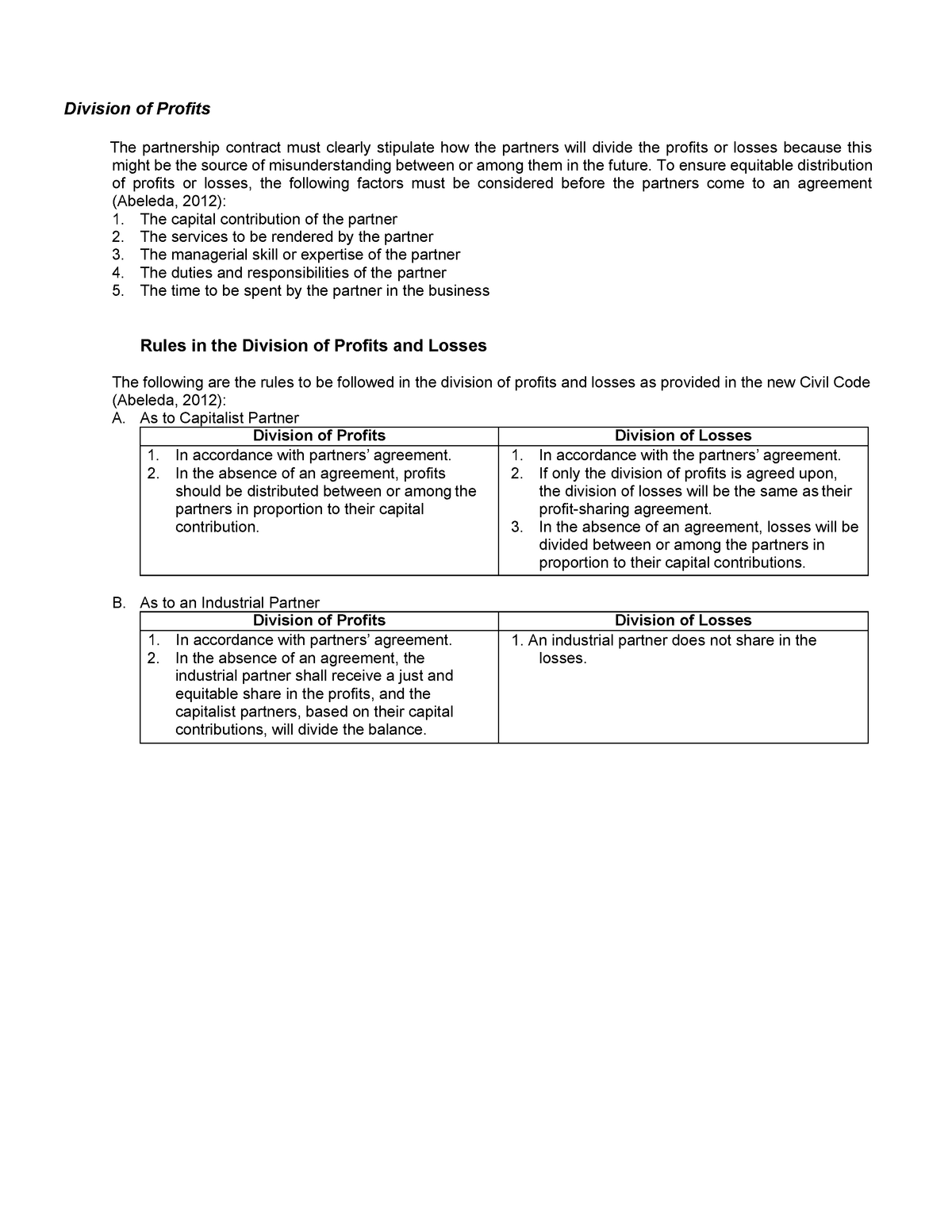

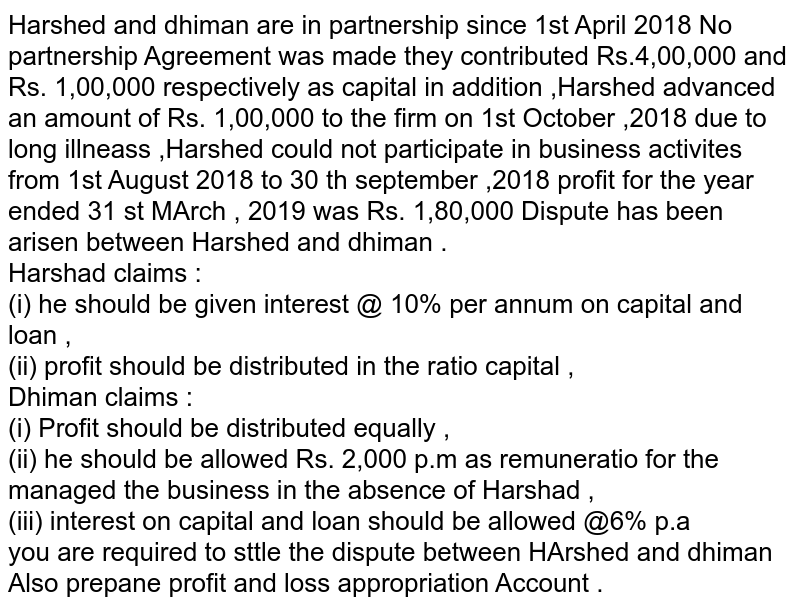

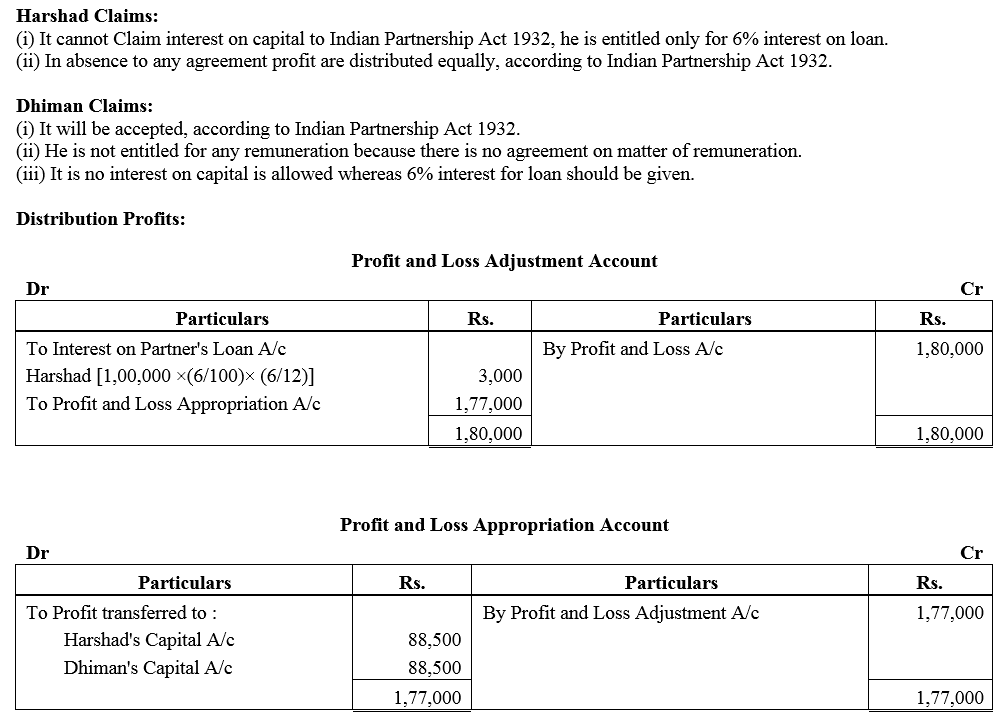

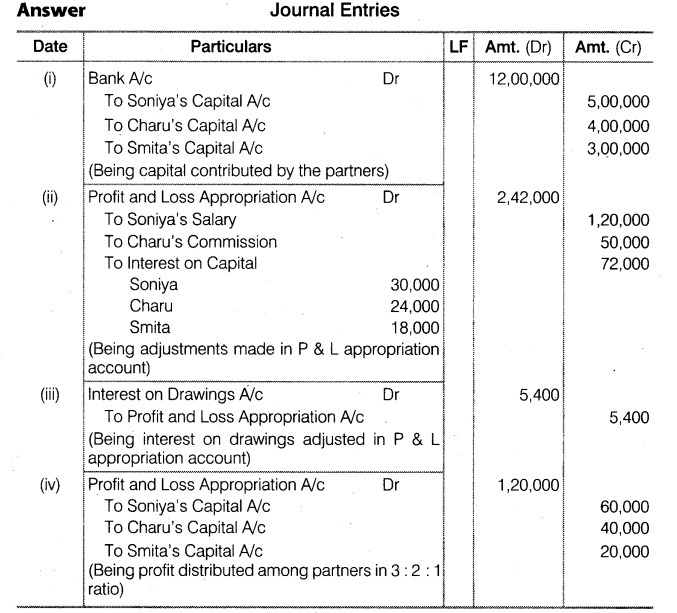

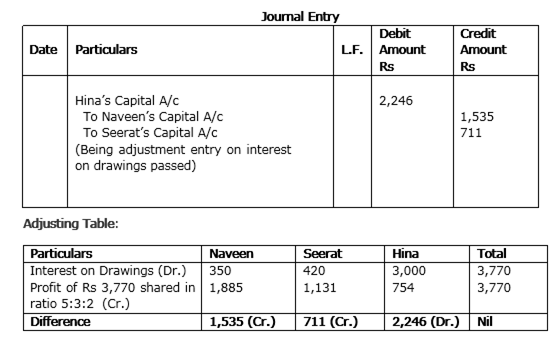

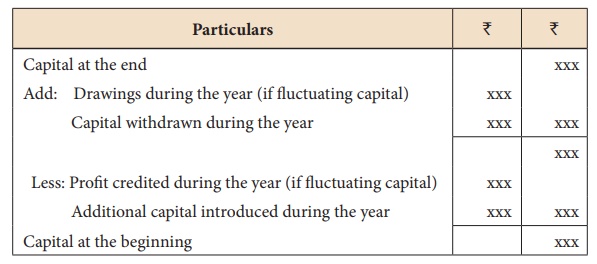

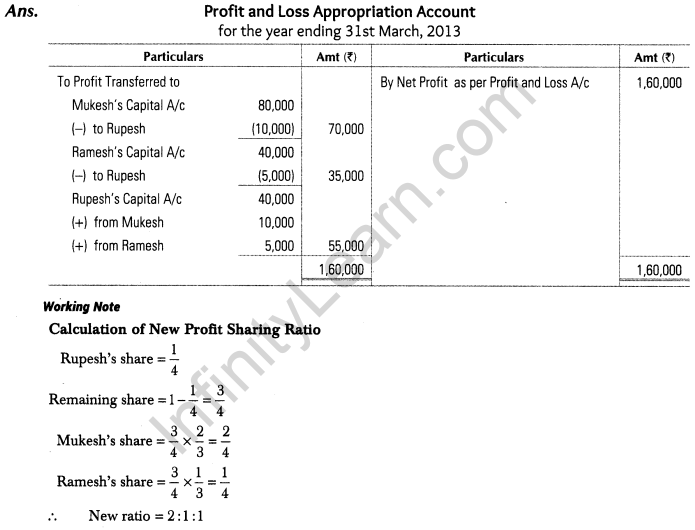

In absence of partnership deed how is profit distributed- In this account how the profit or loss among the partners of the firm is distributed is shown Through this account, all adjustments in respect of partner's salary, partner's If no partnership deed is created, the following rules apply The partners have an equal share in the profits and losses of the business The partners do not receive a salary Interest

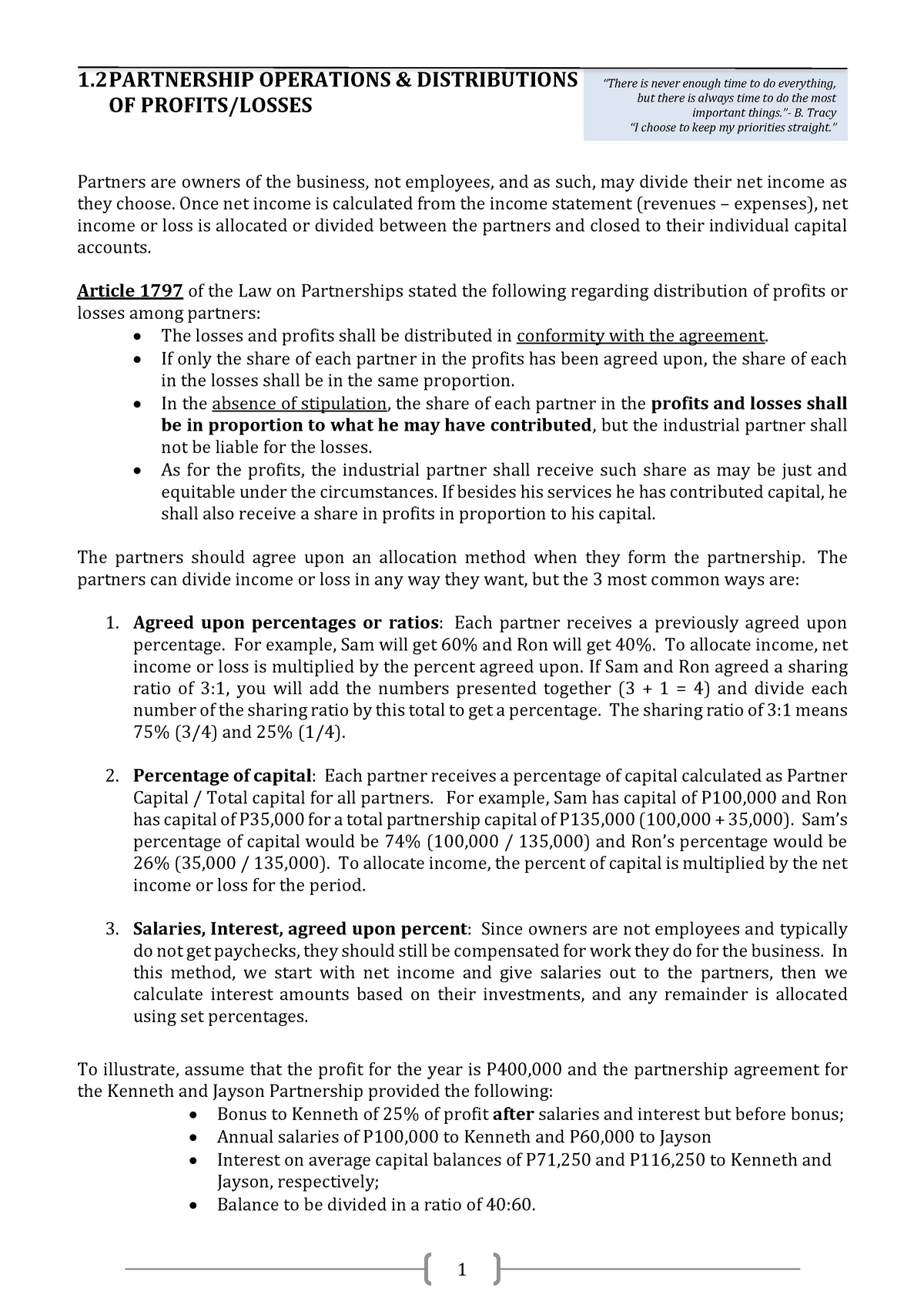

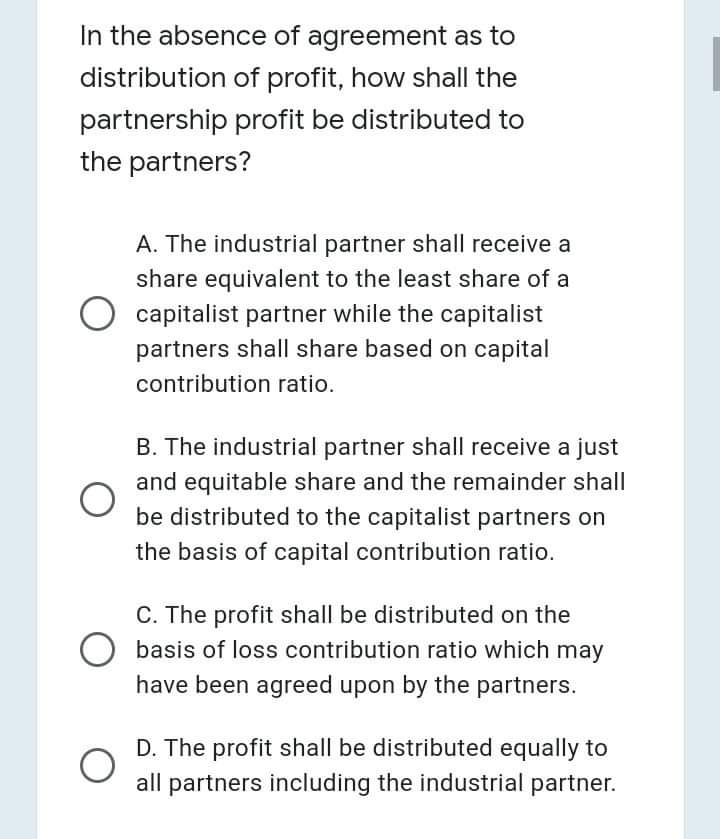

1 2 Partnership Operations And Distributions Of Profits Or Losses 1 Partnership Operations Amp Studocu

In the absence of partnership deed the profits of a firm are divided among the partners (a) In the ratio of capital (b) Equally (c) In the ratio of time devoted for the firm s Their fixed capitals were A ₹ 9,00,000 and B ₹ 4,00,000 The partnership deed provided the following (i) Interest on capital @ 10% pa (ii) A's salary ₹ 50,000 per year and B'sPartners Thus, no interest on capital is payable if the partnership deed is silent on the issue Further the interest is payable only out of the profits of the business and not if the fir m incurs

In the absence of partnership deed, the profit will be divided among partners a In the capital ratio b In equal ratio c In any ratio d Not in any ratio?(Absence of Partnership Deed) Diego, Roman and Soren are partners in a firm, they do not have a partnership deed At the end of the year, following problems were faced by them (i) Diego andAccording to Partnership Act 1932, in the absence of any agreement between partners , profit and loss must be shared equally , regardless of the ratio of the partners investments If the

In absence of partnership deed how is profit distributedのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |  Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

「In absence of partnership deed how is profit distributed」の画像ギャラリー、詳細は各画像をクリックしてください。

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks | Accounting Treatment For Interest On Partner S Capital Geeksforgeeks |

The partnership itself reports profits and losses to the IRS on a special form (so that the IRS knows how much you receive), and you pay the taxes on your portion How do 21 In the absence of Partnership deed, partners are entitled to interest on capital F 22 Interest on loan advanced by a partner to the firm shall be paid even if there are losses in

Incoming Term: in absence of partnership deed how is profit distributed,

0 件のコメント:

コメントを投稿